Hurry up

Apply for NordCard credit line right now!

Creditline up to 10 000 EUR!

To feel the beauty of life...

Get a credit line with individual % rate

Pay only for what you have used

Enjoy flexible repayment options

Credit amount:

0 €

Fixed monthly payment:

0 €

*

*Credit line with individual rate from 2.4% a month

Using a 300€ loan, the APR is 35.0%, the annual interest rate is 28.8%, and the total cost of the credit is 263.91€. This example is based on the assumption that credit is repaid according to the loan agreement and the monthly interest rate is 2.4%.

Get a credit line with individual % rate

Pay only for what you have used

Enjoy flexible repayment options

Apply for a loan quickly and easily!

Have questions?

Leave your phone number and our specialist will contact you. We can tell you everything about the NordCard creditline!

NordCard - best solution for everyone who wants to borrow in the short term

Advantageous, fast and won't charge you a loan extension fee

How Much Can I Borrow?

Applying for NordCard creditline, you can borrow any amount varying between 100.00 and 5000.00 EUR. NordCard guarantees an individual approach to each client, and thus we may offer you bigger or smaller amount than was required in your application.

When I will get creditline?

Your application for NordCard creditline will be reviewed within one working day (9:00-18:00). Our answer regarding our credit granting decision will be sent to your e-mail address. If necessary, we will contact you by phone.

How quickly will I get money to my account?

The creditline amount will be transferred within one business day from the moment of confirmation of the application.

Discover a world of endless possibilities

Why Creditline?

At times, when we need a quick loan, we frequently start to consider two options – a payday loan or consumer credit? Our advice – forget about both; better choose a creditline!

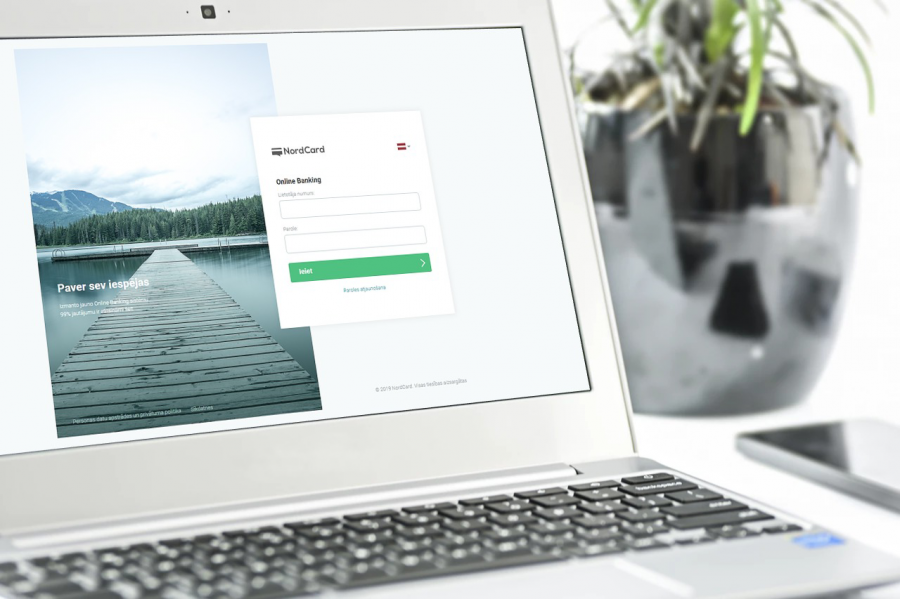

NordCard Online Banking System

Clients, their wishes, opportunities, and comfort, have always been at the heart of every decision NordCard has made. Thus, NordCard Online Banking system was created!

With the NordCard Payment Card, Creditline Is Always by Your Side!

NordCard offers new multifunctional payment card! Now creditline is available with a separate NordCard payment card, allowing you to make purchases immediately, without having to request creditline transfers to a bank account.

4.4

4 875 votes

Reliable

Average rating of NordCard services

"Best credit line! Application process is very simple. I received my money very quickly. Thank you NordCard!" Laura